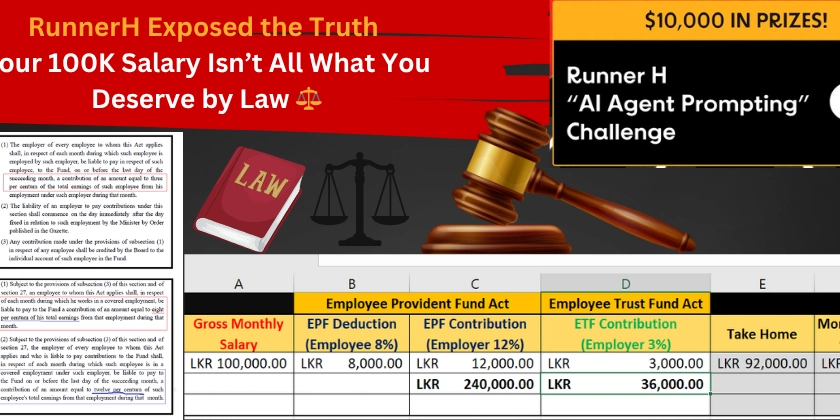

Runner H Exposed the Truth: Your 100K Salary Isn’t All What You Deserve by Law ⚖️

This is a submission for the Runner H “AI Agent Prompting” Challenge

Demystifying PF & ETF deductions with RunnerH prompt engineering—no code, just powerful prompts.

Context – Using Runner H’s Agent’s Reasoning Power to Demystify Employee Benefits in Sri Lankan Legal Context

Legal calculations—especially those involving Sri Lankan employment law — can feel like wading through quicksand. 🤯

Understanding EPF/ETF contributions, take‑home salaries, and compliance requirements usually means parsing dense regulations and crunching numbers by hand.

This Runner H submission shows how AI agents can reason over legal documents and answer complex labor‑law questions with structured prompts—zero code required.

LegalReasonrAgent: a prompt‑based legal assistant that explains statutory salary deductions and employer contributions under Sri Lankan law in plain, actionable language with the power of Runner H AI Agent.

1️⃣ What I Built using Runner H

LegalReasonrAgent is a structured‑prompt AI built on Runner H.

It ingests legal documents (e.g., the Employee Provident Fund Act & Employee Trust Fund Act) as context and tackles a realistic scenario:

- 🧑💻 Employee: Software Engineer

- 🏢 Company: Private sector (Sri Lanka)

- 💰 Monthly Gross Salary: LKR 100,000

The agent then calculates:

- Employee + Employer EPF/ETF contributions

- Annual fund accumulation

- Take‑home salary

No code, no spreadsheets—just **context + prompts + RunnerH magic

2️⃣ Demo – 13 Minutes Complete Step-by-Step Process [Must Watch}

3️⃣ How I Used Runner H

Building LegalReasonrAgent wasn’t about writing code — it was about engineering clarity through conversation.

Here’s exactly how I used **Runner H **to reason through Sri Lankan labor law with nothing but structured prompts and legal documents:

✍️ Step 1: Upload the Legal Context

I started by uploading publicly available legal documents related to Sri Lanka’s EPF (Employees’ Provident Fund Act) and ETF (Employees’ Trust Fund Act). This included official contribution rules, percentages, and statutory obligations for employers and employees.

✍️ Step 2: Design a Structured, Role-Playing Prompt

Instead of issuing vague instructions, I carefully crafted a persona-based prompt:

You are LegalReasonrAgent – a legal reasoning AI assistant trained on Sri Lankan labor laws and payroll regulations.

By referring to the attached legal documents and based on legal reasoning, please answer the following questions in a clear, step‑by‑step manner.

╔════════════ EMPLOYEE DETAILS ════════════╗

• Role: Software Engineer

• Company: ABC XYZ (Pvt) Ltd, Sri Lanka

• Monthly Gross Salary: LKR 100,000

╔════════════ QUESTIONS TO ANSWER ═════════╗

1) What is his monthly gross salary?

2) What is his monthly take‑home salary after EPF deduction?

3) What is the monthly EPF contribution by the employer?

4) What is the monthly ETF contribution by the employer?

5) How much fund will be added to his EPF account annually?

6) How much fund will be added to his ETF account annually?

Please include applicable contribution rates and use official Sri Lankan EPF/ETF contribution rules as reference.

⚠️ Disclaimer: AI‑generated outputs may not replace professional legal advice. Always verify with a legal practitioner or labor consultant before taking action.

This framing helped the AI act like a legal consultant, interpreting context and returning step-by-step answers based on factual obligations.

✍️ Step 3: Frame Questions Logically

I included real-world input variables—job title, salary amount, and company type—and asked targeted, logical questions around:

- Take-home salary after EPF

- Employer’s EPF + ETF contribution

- Annual fund growth for the employee

This made the prompt reusable and modular.

✍️ Step 4: Run the Prompt in Runner H

With context + questions in place, I launched the workflow in Runner H’s no-code environment. The multi-agent engine parsed the laws and applied arithmetic + reasoning to deliver precise outputs—including formulas, figures, and interpretations.

✍️ Step 5: Output by Runner H Agent

To calculate the requested information based on the provided legal documents, let's deduct the relevant percentages from the employee's monthly salary and determine both the Employee Provident Fund (EPF) and Employees' Trust Fund (ETF) contributions as well as their effect on the take-home salary:

His monthly salary:

LKR 100,000

His monthly take-home salary after EPF Deduction:

The employee contributes 8% of their salary to the EPF.

EPF employee contribution = ( 100,000 \times 0.08 = 8,000 ) LKR

Monthly take-home salary = ( 100,000 - 8,000 = 92,000 ) LKR

Amount of EPF Contribution by the Employer:

The employer contributes 12% of the employee's salary to the EPF.

EPF employer contribution = ( 100,000 \times 0.12 = 12,000 ) LKR

Amount of ETF Contribution by the Employer:

The employer contributes 3% of the employee's salary to the ETF.

ETF contribution = ( 100,000 \times 0.03 = 3,000 ) LKR

How much fund will be added to his EPF Account annually:

Total annual EPF contribution (employee + employer) = ( (8,000 + 12,000) \times 12 )

Annual EPF contribution = 240,000 LKR

How much fund will be added to his ETF Account annually:

Annual ETF contribution = ( 3,000 \times 12 )

Annual ETF contribution = 36,000 LKR

Disclaimer: This analysis is based on the current understanding of the legal documents and percentages mentioned within them. It is highly recommended to consult a legal practitioner or financial advisor for any actions based on these calculations, as an AI-based interpretation may not encompass all the complexities of legal requirements.

✅ Step 6: Review and Verify

I double-checked the generated output against trusted HR resources and official EPF/ETF guidelines to ensure accuracy and compliance.

Shockingly…

the Output is perfectly align with the Manual Finding and the Legal Provisions

⚠️ Note: Check the above Demo video to understand how the provisions apply and then the output generated by Runner H’s reasoning

By combining intent-driven prompt design with Runner H’s structured agent execution, I transformed a traditionally manual, error-prone task into an automated legal reasoning assistant.

No API calls. No spreadsheets. No legal team.

Just Runner H + one powerful prompt = Instant legal insight ⚖️✨

4️⃣ Use Case & Real-World Impact – Who Benefits

When building LegalReasoningAgent with Runner H, my goal wasn’t just to create another AI prompt. It was to solve a real, recurring problem faced by millions of working professionals across the World.

Here’s how and who this AI Agent can actually serve in the real world

🧑💼 1. Employees

Most employees receive a salary slip, but don’t fully understand where their money goes—especially when it comes to EPF/ETF deductions and fund contributions.

With LegalReasonAgent, they can:

- Understand exactly how much goes to EPF and ETF monthly and annually

- Know their actual take-home pay after mandatory deductions

- Be financially literate and plan for retirement or future withdrawals

- Verify if their employer is compliant with labor law obligations

📊 2. HR Managers & Payroll Officers

For HR teams, especially in SMEs and startups, salary structuring and compliance can be overwhelming. Many don’t have internal legal staff or automated tools.

This tool helps them

- Cross-check payroll outputs with legal expectations

- Simplify salary breakdowns for onboarding and offer letters

- Ensure full EPF/ETF compliance and avoid regulatory penalties

- Create better transparency with employees during salary reviews

🧠 3. AI Builders & Prompt Engineers

LegalReasonAgent is a showcase of how structured prompt engineering can simulate legal reasoning — a field often seen as too nuanced for LLMs but as per the experiment Runner H outperforms.

For AI builders, this use case highlights:

- The power of document-anchored, persona-driven prompts

- How to handle domain-specific logic without APIs or custom code

- A reusable prompt design that can be applied to other jurisdictions or legal systems

- The opportunity to build no-code compliance tools using RunnerH

⚖️ 4. Legal Educators & Law Students

Understanding how laws are applied in practice can be difficult for students and early-career lawyers.

This use case provides:

- A practical, AI-assisted teaching tool

- A method for interactive legal case simulations

- A way to automate routine legal logic and focus on higher-order interpretation

- An intro into how AI can support legal analysis, not replace it

🏢 5. Startups, Freelancers & SME Founders

Founders and freelancers often don’t have HR consultants or payroll software. Yet they are legally bound to pay EPF/ETF for their employees.

This AI agent gives them:

- A quick, trustworthy breakdown of what they owe

- An automated advisory that replaces hours of manual research

- Peace of mind that their company is staying within legal limits

🚀 The Broader Impact

Ultimately, LegalReasonAgent isn’t just about calculations.

It’s about democratizing legal knowledge, empowering employees, and enabling businesses to be smarter, faster, and fairer—using nothing but structured prompts and AI reasoning.

From 100K salary confusion to transparent, AI-backed clarity – this is legal tech made practical for everyday users.

Social Love

👉 On Platform X

👉 On Youtube

Credits: I owe credits to my team members @oliviaaaron and external legal practitioner in proofreading our understanding with regard to the application of law and for the voice by my team member.

💬 Have a salary breakdown you want verified? Drop a comment or remix the prompt for your country. Let’s make labor law understandable—one prompt at a time.

⚠️⚠️⚠️ Disclaimer: AI‑generated outputs may not replace professional legal advice. Always verify with a legal practitioner or labor consultant before taking action.