From Coins to 25%, 1.10k+ in equity at 18

Below is my life story from a financial perspective. Specifically how I

started from collecting coins at age of 5 and then reached 100,000+ in

equity at 18.

This is my personal story. None of it is financial advice, if it wasn’t

obvious by now. Many people have asked me to include what stocks did I

buy, what strategy did I use. Giving financial advice without proper

certifications, which I neither have nor want, is a crime according to

the government. Also I don’t want to reveal my cards. Additionally the

document itself is licensed under CC-BY-NC-SA, which also includes a “No

Warranty” clause.

Table Of Contents

Childhood Interest in Coin Collection, 5 – 6

This is probably the hobby that paved the way for my interest in

finance. While I mostly collected exotic Indian coins, I also did have

some paper notes, and foreign currencies too.

Most of my coins came from buying it from beggars at a price higher than

their face value.

This hobby was kinda expensive and required traveling to some

potentially unsafe places. It was impossible for 5 year old me to

sustain it, so I soon at age 6, I left it.

Below is the picture of notes from my collection. 4 Indian Rupee notes.

3x One Rupee and 1x of two rupees

Collecting, Trading Stationery(9 – 11)

I started collecting stationery at age of 9. By the age of 10, I had

started taking my stationery collection seriously. I also introduced

this hobby to my classmates, and it spread like fire. I also started

trading stationery with them. I named this act “Soada”, which is Punjabi

word for “deal”. I mostly traded stationery for non stationery items

including food, money and others. I kept a written, signed bill of each

item traded for just in case. I also introduced written form of

communication in form of paper balls letters with some obscure words.

Some of my most notable trades were soft drink, chips nuts, and which in

return, I got two pocket sized Oxford dictionaries. Cash, listening to

stories of a classmate’s father stationery shop from which I got an

obscure sharpener from her. Pack 50 pens, 2 Rupee, each from a village

student for cash. Mathematics table, formula notebook, which I wrote

myself, for which I got 5 sharpeners in return. An imported chocolate,

for which Y testified, post trade, in boasting manner that it’s indeed

imported, in return for 7 sharpeners. A small carton of juice(10 rupees)

for mechanical pencil(worth 15 new) from Z. She believed in mobile app

ghosts, played video games, ate meat(which was considered taboo), and by

her own admission, was “Not like rest of girls”. She later even started

doing experiments, playing pen fighting with me, and other minor trades.

I was specially fond of pencil sharpeners and pens. I had 97 pencil

sharpeners, 70+ pens, 30+ erasers. Thefts were pretty common too, so I

had “secret pockets” in my bags, coats which were carved out using

sharpener blade. I also managed to convince some thieves to not steal my

items, else I will complain them to our teacher, A, who considered me as

her “favorite student” and gave me “Smart and Cool 😄” on official

report card, and keys to her personal locker in staffroom, exemption

from makeup(skin whitening powder, lipstick), because I am already pale,

and allowing me to wear my own jacket function and allowing me to wear

my own jacket. While I had access to A’s personal locker, I never used

that for my personal storage or even requested her for that.

There were also some ideological differences. For example, one rival

turned trading partner collected pencil leads from wooden pencils by

repeatedly sharpening it, which I, and A both, found valueless and waste

but we didn’t object. Another one was with many others who were so keen

on displaying their collections publicly to almost everyone but I was

opposed to this. Due to concerns of theft and whole class already knew

this. But some show off was also necessary as form of advertising, so I

kept my bragging tendencies to limited circle. I used to say, “Why

should I bend and look down , laugh on others instead of making others

look up and they will notice automatically.”

In addition to that, we did many other things including Pen

fighting[^1], “experiments” with stationery, writing

short reference books, throwing our stationery out of window on the

porch and then rolling them down through water pressure. The one who

managed to do this could keep all of them.

I stopped this hobby at age of 11 because it was getting way too

expensive, my step mother had discovered my stash, thieves had left the

school, our school was getting strict to the point that they confiscated

my cash, expensive stationery. Though I got them back after my father

wrote a note to them.

And I also became favorite student of another teacher, C. She appointed

me as discipline manager, time tracker for her class. I also helped her

by facilating a profitable business deal with my father. And another

seperate business deal with a classmate, BD, who would later become a

bad debtor of me.

I also had started focusing on programming and later finance. Though my

stationery didn’t go waste. I personally donated many to poor students,

including poor non-school friends(Group A), who passed an oral test, and

still use some of the items.

Making Beer Money, 12.5 – 13.5

At the age of 12.5, I created a Paytm account with Mini KYC, from my

father’s documents, with his consent obviously. And started earning

through referrals, micro tasks, quizzes and some real money gaming.

I didn’t really do real money gaming much as I knew that I often lost,

except in one game in which I managed to earn around hundred rupees. I

didn’t do sports betting, rummy, poker as I didn’t have enough

knowledge, neither desire to gain it.

I must have earned a total 600-700 rupees overall, without any

investment, but I then just stopped as the work to reward ratio was too

low. But for me, the biggest feeling was earning something. I still

remember that I playfully bantered with my classmates that I have

already started earning, have more cash in my wallet than them, who had

none.

I didn’t share much about these platforms in my group, other than the

Crypto currency platform, and Google Opinion Rewards, as many of these

platforms were specific to India, and few required investments. And I

used to say that, “I will make sure that my group members don’t have to

pay a single cent from their pocket” as a comparison to of other group

admins or YouTubers.

Making My First Profit From Cryptocurrencies (14 – 15)

After learning programming for 1.5 years, at the age of 13.5, I created

my own

group

for computer, cybersecurity related discussions, that gained over 100

members, and I started learning about finance, stocks, cryptocurrency.

At the age of 14, after I gained working knowledge of block chain,

cryptocurrencies and related fields, I started searching for ways to

implement my knowledge. I came across a platform named

Stormgain which had a feature that would let

you mine Bitcoin on their cloud platform for free. So I signed up there

and started mining.

I was able to refer around 5 people in Sethi Free Hacking School, which

increased my mining rate. Soon, I reached \$10, the minimum withdraw

limit, and withdrew my earnings to my trading account, there was no

option to withdraw to bank account, crypto wallet. From that, I bought

Matic USDT and made \$13.

But sadly, I wasn’t able to withdraw the profit because I didn’t have

legal documents, as I was a minor. After that, I just abandoned

Stormgain, cryptocurrencies and started focusing more on programming,

equities instead. Though still I did manage to make \$105 profit in demo

account with BTCUSDT and COMPUSDT

Earning Money By Doing In-game Micro transactions for others (14 – 15.5)

As I shared in my previous

article

that why I am not a game developer and why I don’t play video games, I

was safe from this “disease”. But many of my friends did, and they

didn’t have much means to do in-game micro transactions as they were

minors too.

I had already opened a mini KYC Paytm account at age 12.5 using my

father’s documents, as I mentioned above, and had knowledge of these

things so I did micro transactions on their behalf.

Most of micro transactions I did were in video game named Free

Fire. I would buy

a Google Play Gift card using my Paytm balance and then share code with

them. Sometimes, I also did direct top ups using

Codashop.

I had started this at age of 14, but later stopped doing micro

transactions altogether, due to bad debt with BD, and instead parked my

money in Paytm Payments bank FD. I also stopped going to his home as I

was spending more in fuel. I had already earned lot of profit by

arranging business deal between BD and my father at age of 11, so I gave

up.

Since Paytm is not a traditional bank, I couldn’t go to a bank to get

money deposited. So, I would have to go to some mobile recharge shops,

and later a friend, who would take cash, commission from me and send to

my Paytm account. For this reason, I would charge some “commission” too.

Due to it not being a traditional bank, once a credit worth 4,500 was

freezed. I did not have UPI and my friend did an UPI payment. It stuck

there for 5 months until suddenly, at age 15, it was credited after

hours of verifications and talks with customer care.

My opening balance at age 14 was around 1,500 rupees, but my closing

balance, at the end of age 15, was around 16,000 rupees. While I did

loose around 500 as bad debts to two of my friends, including EC from

C-1 who is described in Fanclub section of Leadership Autobiography. I

then stopped doing transactions for them. Overall, it was fun and

profitable!

A boy(SM) who was 2 year older than me, 16, but shorter, had discovered

that I often carried cash to get deposited from my friend. He once tried

to mug me near that place by blocking my way and an unsucessfull arm

bar. He was accompanied with another 16 year old boy who did not

interfere much. After 5 minutes of resistance, I managed to push him

down and run away. SM tried to grab my backpack to stop me from running,

but he ended up stumbling again after the strap tore away. I did not

give him any money, and he afterwards never dared to mess with me.

Below is a chat screenshot from one of my friend. Translation He: Hello,

Harshit. Me: Yeah. He: Russian one. Me: Lol, yes. He: Do you have money

in Paytm? 700? Me: Yes He: Okay I will send you a number, send it there.

Me: Okay, send.

Later in 2024, “The Reserve Bank of India (RBI) ordered the payments

bank subsidiary of Paytm, to stop accepting fresh deposits in its

accounts or popular wallets from March.” Source:

Reuters.

But I had long ago withdrawn it, so it did not affect me.

Trading Equities Using Investopedia Simulator (15.5 – 16)

Even though it was a demo account, I played safe and only bought

securities which I would feel confident buying from my real money. I

also bought some cryptocurrencies including Dogecoin, Ethererum,

Bitcoin, but my main focus was on equities.

As of 2024-11-10, My abandoned account have 174 % profit, but it’s just

a demo account, so I can’t really withdraw it.

Starting Equity Trading Using My Father’s Account (16 – 18)

At the age of 16, I finally managed to convince my father to open a

demat account for me. Earlier he was using multiple excuses including

how he lost so much money, “what if step mother discovered this”, “focus

on studies”, “invest in gold”, and more. But when I showed him my demo

account and demonstrated my knowledge, he agreed. After extensive

research, I choose Zerodha as

my broker, because it was a discount broker, that charges less fees than

full-service ones. My father had initially opened an account on a

full-service broker, but after I explained him charges associated with

such brokers, he let me open account at Zerodha, using his documents.

Within six months, I managed to earn 10% profit by investing my

savings into low expense ratio ETfs and few individual stocks. For

reference, not all ETFs are Index Funds, which track an entire index as

whole. The ETFs that I invested in had cherry-picked holdings from a

specific index.

During this age, I also started learning about XMR(Monero).

Specifically, it’s algorithm and implementation. I experiminted with

it’s testnet network, mining etc. As screenshot below shows, I managed

to get collect 10 XMR(Testnet).

At age of 17, I started learning about various equity related strategies

through paper trading, backtracking, using a stock screener, refined

mine one, moved from ETFs to individual stocks, because I enjoyed

researching different sectors, companies, and also for higher returns.

Also reached around 16% profit.

Preaching Finance to Classmates, 17

At the age of 17, after lot of explanations, fearmongering by me, one of

obsessed classmate, from C-2C, created a demat account using his parents

documents, just 3 months before final exams. He took accountancy

homework very seriously, where I did not even care and was even

basically exempt from it by teacher, allowed to only do examples. He

wanted to pursue B. Com from Delhi University, one of most prestigious

for business courses. Despite having reservations, he wasn’t able to.

Which makes what you will read further to be even more absurd.

He initially choose Groww and created account with his father’s

document, but I suggested him to switch to Zerodha, due to low expenses,

and create account from someone with lower income tax slab rate, and he

did. I had also gave him a rough idea of good blue chip stocks to invest

in. He also took my advice, but ended up making a loss.

His first trade resulted in a loss. When he came to class the next day,

he told me that he had accidentally sold it and will again buy it today.

He then again did the same mistake.

The next day he came to class and offered to drop me back home, I

refused but he then said he wants to talk about stock market, so I kinda

agreed. In the mid way, he started sharing what had happened to him,

accusing Zerodha to be a scam company etc. But he couldn’t even tell how

much loss he made on each trade. He simply told me the difference

between his initial capital and current one, which he did using

calculator after in my presence.

Then I went through his accounts myself, in his phone, and quickly found

the error in the tradebook. While the tradebook is deep buried in

console, and UI isn’t that friendly, an investor ought to have knowledge

of platform before starting. As I suspected, he was doing intraday

trades using MSI instead of Cash and Carry(CNC). Due to which, he not

only paid higher charges, but also suffered from market volatility. The

first trade caused him a loss of around -500, the second he got slightly

lucky and ended with ony -192 loss. I calculated these by myself by

subtracting selling price from buying price, which may seem simple, but

there was no UI which showed outcome of each trade, and he himself was

confused by words like “LTP”, “average price”.

I then suggested him just to close his account. He said he will keep

account just to check stock prices, but wouldn’t trade. When I told him

about AMC, he got shocked that expense also exists and then thanked me,

asked me for account closure process. I directed him to Zerodha customer

care, which he had around 20 minutes talk with. I didn’t want to reveal

my home location to him, so I told him to drop me at a common

destination, and then I walked back home. Ultimately, even his offer to

drop me didn’t prove to be beneficial to me, as I had to walk

significant distance.

So in the end, he suffered a total loss around -1,000 including 200

account opening charges, which was all preventable.

His fault was that he ignored the perquisites, and didn’t do any

research himself. The signs were clear: beta value was high, RSI was

showing overbought and PE ratio was above 50. His first ever trade was

done using real money, which you should never. Always start with paper

trading. Despite being familar with financial ratios, balance sheet

anysis from education, and doing thoussnds of questions on them, he did

not even apply those concepts. He also didn’t ask for my phone number,

from me or anyone. All of our communication were in class. I could

potentially help him earlier if he had messaged me. Though members of

C-2A, biggest faction within class, congratulated me for “causing” his

loss.

Same classmate who is shown in screenshot above, requesting me to do 700

rupees micro transaction, asked my advice after investing in an IPO.

After I told him that the industry he invested in has almost total

monopoly, he sold those shares at a minor loss. My advice was provetd to

be true as the stock fell after just few months of IPO. I had gained

this knowledge by actually spending my time in a shop concerning such

industry. I was familiar with what customers demanded and what fear

mongering shopkeepers used.

Starting Equity With My Own Account (18 – Present)

From just a day next to my eighteenth’s birthday, I started preparing

for creating my demat account, because I knew that it would be a lengthy

process. I started by applying for pan card, which is necessary to

create a bank and equity account.

As soon as my Permanent Account Number(PAN) card got delivered to my

home, I went to bank with my father to get my account converted from a

joint minor account to personal savings account. It took around 2 weeks

for everything to get ready. After that, I created my own demat account

at Zerodha. Surprisingly, my account got activated within 48 hours but

now I had to transfer equities from my father’s account to my account.

It was again very lengthy process that involved creating accounts on

CDSL website, setting up beneficiary, verifying documents, but I again

managed to do it on my own. Sadly, this wasn’t the end.

After the securities got transferred to my account, I faced yet another

issue. The issue was that only number of shares were visible, but their

book value wasn’t visible.

After researching on internet, I found that it’s a common

thing.

Now I had to manually enter the book value, date of purchase, amount of

each share. I initially became a bit worried on how would I get that

this data, as the shares were transferred from my father’s account. I

went through bank statements, chat logs, screenshots and created a CSV

file of all the transactions I could recover. To ease up the process, I

wrote a simple Python script to automatically calculate average price of

stocks and append it to CSV. But this wasn’t enough. Not only the

dataset was incomplete, but it also had some small differences than book

value of shares which were caused by various charges including

brokerage, tax.

Fortunately, when browsing through my father’s demat account, I found a

way to export old transaction history as CSV. I ran a modified version

of my script and created a clean CSV file.

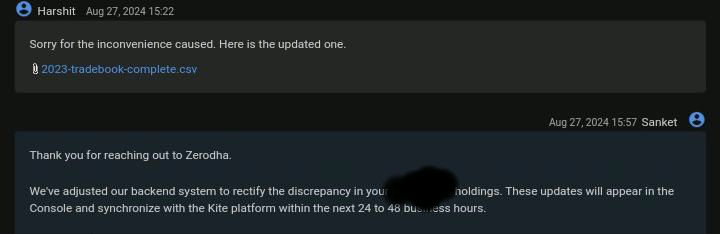

But still, around 65 shares still had discrepancies. The UI and docs

were extremely unhelpful too. I ended up sharing my CSV to customer

support and they fixed my issue within 4 days. Interestingly, they also

admitted that there were indeed issues in backend.

It took around 2 months in all this but after that I could enjoy the

fruit of freedom, my efforts. Soon, I also reached 25% in equity

Edit:1 Some “readers” from a technical analysis community have been

arguing me that I should have sold and rebought the shares, instead of

transfering them, as transfering is a long process. Well, If I had did

what that then I would have to pay additional tax, and also I would

loose that 20%. If I had sold them, then I would not be sitting on 25%

profit and would not be writing this article. Also they were telling me

that I would not have to pay tax, as my income is low, but I was trading

from my father account. If I had sold using his account, that would have

caused tax liability. I thought it would be obvious hence, I did not

clarify it. < /p>

Edit2: Within a month of writing this article, I was able to double my

capital. I did this with combination of taking advantage of “Largest Con

of Corporate history” by Adani, as reported by

Reuters

even though I heard this news after closing of market, different

strategies and willpower. I am not going to hold Adani stock for a long

time due to: extremely high PE; high equity to debt ratio; coal,

cronyism etc. They, the readers mentioned in first edit, used to say “A

dip*** kid came here to flex his 25% profit on 35K capital and how he

saved on taxes …” but I never cared much. If I had been arguing with

them, I would have never reached here. Below is my P/L as of 2024-12-18.

The small red is due to a stock is due to a single stock, but overall

it’s all green. I will just book profit and sell it ASAP, in fact I have

placed a sell order already.

Becoming Self Made Equity Lakhpati In Bear Market, 18

Lakhpati means someone who has more than 100k rupees. I used this word

instead of millionarie because the later implies USD. I have now changed

the title of this article to simply “1.10k+” to be more clear.

Despite the market conditions being bearish, Sensex down by 3,000

points, according to Times Of

India.

My profit % being down than earlier, 25, due to aggressive trading, I

managed to reach my goal. It is an extremely difficult thing to reach

this goal in bull run, but I did so that in Worst bear run since 29

years , as Reuters article linked below reports, and at age of 18,

just 4 days before my first semester exams.

Edit3: 2025-02-15. I am extremely happy to announce that I have become a

Self made, Equity Lakhpati in the bear market, by the age of 18, by

having investments worth 1,00,000 Rupees at market value.

But unfortunately, since today is Saturday, I can’t do the trade today,

but I have placed a limit order worth 9,000 which will get executed on

Monday. I already have 92,000 so even if it doesn’t become green that

time, I would still be Lakhpati. So basically nothing can stop me. I

will upload the screenshot on Tuesday, because I just can’t control my

laughter today and also after delivery so that people don’t say I did an

intraday trade.

Also it looks like my decision to not hold Adani was yet another right

one. Currently Adani is down again, and it’s due to coal as Times of

India

Reports.

If I kept holding it, I would have not become a Lakhpati this soon.

Edit 4: 2025-02-17, turns out my another decision was correct, my

premature celebration was not wrong. In the end, I had the last

laughter, but it was not my last laughter. Not only my limit order got

executed below the market price, but I am now sitting at 1% up in

positions. I can technically sell it and be profitable, but I am going

to wait for delivery. I have uploaded screenshot of positions on

Linkedin.

Edit 5: 2025-02-18. For those who like to keep a count, my yet another

decision was correct. The market value of my portfolio is above 1L, even

before opening of market, and below is a screenshot of my P/L as

promised.

Edit 6: 2025-02-20, Adani stock is down again by 4.5% due to bribery

charges by USA, as Times Of

India

reports. A bit of old news as I don’t consume news and I don’t have high

expectations, unlike what high, artificially infalted, PE ratio of

company says.

Edit 7: 2025-03-03 Despite not studying at all, focusing on stock

market, poor conditions, I was the first one in folllowing cases:to

complete all of my first semester exams; announce the results are

declared; discrepancies in them; help students in it. I completed all 5

exams, which were of 150 minutes, with M: 24.2, SD: 2.4 and SGPA of

7.6. See descriptive statistics, evidences in this

gist.

Also it looks like stock market is falling more with

Reuters

describing it as “Worst run in 29 years”, but I still achieved my goals

despite that.

Edit 8: (2025-03-08) Despite the continued bear trend, I was able to

take the trash out of my portfolio, free up capital. A limit sell order

I had earlier placed has been executed. I did lot of mental

calculations, even including transaction charges, managed my greed and

set a value that will leave me with a net profit. I used the money from

it, and some additional to invest in a good stock. Now even my

investment value is more than1 Lakh. I didn’t invest too much as I also

have to pay college fee too. If I had set GTT high, it wouldn’t be

executed and I wouldn’t be able to take advantage of current bear

market. Now I also have one less company to worry about, and now my

portfolio is above 1.10K.

- Pen fighting is a turn based game played on a table. The goal is to

knock opponent’s pen without directly touching it. Only by using

strikes to own pen. We also modified it further like making it

multiplayer, introducing obstacles, custom pens, whether cap of pen

be considered part of pen or not.

Share your thoughts on Github

issue or

email me.

Written on: 2024-11-10. Last Updated on: 2025-06-01.